- SHOULD YOUR WORKING CAPITAL TURNOVER RATIO BE NEGATIVE HOW TO

- SHOULD YOUR WORKING CAPITAL TURNOVER RATIO BE NEGATIVE PC

When current ratio is greater than 2– let’s say around 2.1 to 2.5, it indicates that company has more than enough resources to pay-off its liabilities. What Changes In Working Capital Impact Cash Flow? Current liabilities are short-term financial obligations due within one year. To ensure that they are using their working capital efficiently, businesses should effectively manage accounts payable, accounts receivable, and inventory levels. If that happens, then the business would have to raise financing to pay off even its short-term debt or current liabilities.

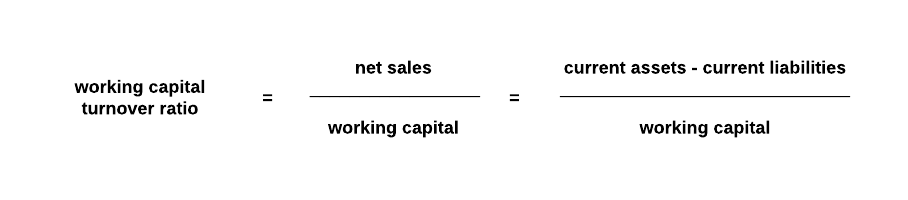

This ratio is also known as net sales to working capital and shows the relationship between the revenue generated by the company and the funds needed to generate this revenue. The working capital turnover is the ratio that helps to measure a company’s efficiency in using its working capital to support sales. To spot an extremely high turnover ratio, you need to compare the ratio for your company with other businesses in the same industry and scale. A higher working capital turnover ratio also means that the operations of a company are running smoothly and there is a limited need for additional funding. This ratio answers the question – How much of revenues are generated per dollar of working capital? High turnover ratios can mean that the firm is using working capital effectively, whereas low turnover ratios could indicate that the firm is not using working capital as effectively. Liquidity measures, such as the quick ratio and the current ratio can help a company with its short-term asset management and are looked at by lenders as part of their underwriting process. Anything higher could indicate that a company isn’t making good use of its current assets. This ratio measures how efficient a company is at using its working capital to generate sales.

One of these formulas is an organization’s working capital turnover ratio. Knowing the answer to this simple question can make all the difference when you’re planning and pursuing new initiatives, strategic growth, or product innovation.So, Working Capital is $10,000 which means that after paying all obligations, Jenna’s Collection has left $10,000 in its short-term Capital.In other words, there is more short-term debt than there are short-term assets on your balance sheet, and you’re probably worrying about meeting your payroll each month.The cash conversion cycle is quicker when financial management achieves excellent accounts receivable collection combined with fast inventory turnover.The tool should be used to better manage those accounts to reduce the firm’s need for external financing.

SHOULD YOUR WORKING CAPITAL TURNOVER RATIO BE NEGATIVE HOW TO

So where does this ratio fit in and how can you use it to inform your decisions? In this article, we’ll explore what working capital ratio is, why it matters, how to calculate it, and what to do with this information.

SHOULD YOUR WORKING CAPITAL TURNOVER RATIO BE NEGATIVE PC

Excel Shortcuts PC Mac List of Excel Shortcuts Excel shortcuts – It may seem slower at first if you’re used to the mouse, but it’s worth the investment to take the time and… While the above formula and example are the most standard definition of working capital, there are other more focused definitions. There are a few different methods for calculating net working capital, depending on what an analyst wants to include or exclude from the value. Most landlords do not extend credit to tenants and move to evict tenants who do not pay their rent on time.

0 kommentar(er)

0 kommentar(er)